When did you realize your credit score was critical to practically everything you did as an adult?

For me, it was when I learned how the credit card options for people with great credit were significantly better than for people who had average or below credit scores. If you have good to great credit, you get access to credit cards with huge sign-up bonuses and rewards.

If you don’t, your options are less attractive and you have to work towards improving your score before you can start applying for great credit cards.

But credit cards are just one small part — if you don’t have good credit, it can be difficult to get a rental apartment, a cell phone, and many other seemingly unrelated necessities.

So today, we’re going to talk about credit scores and how to improve yours.

To start, there is only one credit score that matters, and that’s the FICO Credit Score of Fair Isaac Corporation.

Table of Contents

In this guide, I show you every step you can take to legitimately increase your credit score so you can, at the very least, be better than the average.

What is a credit score in 30 seconds…

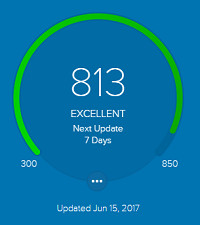

Your credit score is a number between 300 and 850, higher is better. It’s a measure of how likely you are to default (fail to pay) on a loan, the lower the number the greater the risk.

- Excellent credit is 781+

- Good is 661-780

- Fair is 601-660

- Poor is 501-600

- Bad is anything below 500

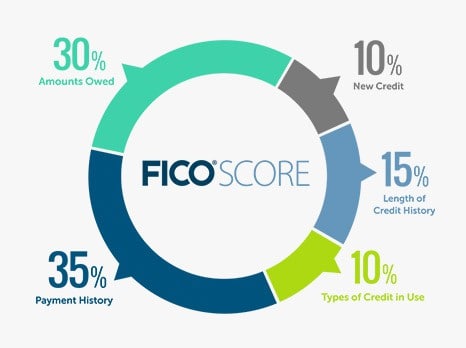

Your credit score is made up of five factors (image from FICO):

You can review your credit score for free with tools like Credit Sesame.

That’s it!

How to Increase Your Credit Score

The key to increasing your credit score is to improve those five factors from the image above.

This guide is broken up into three sections:

- Establishing Credit

- Doing No Harm

- How to Boost Your Score

- And Keeping it High

Establishing Credit

It’s possible, especially early on, that you might not have a credit score at all or the dreaded “not enough credit history.” It’s hard to get a loan when you’ve never had a loan before. But there are a few things you can do to establish a credit history.

If used responsibly, these options will start reporting positive information to your credit report. This will establish some credit history and prove to future lenders that you do pay off your loans.

One note: Only become an authorized user on someone’s credit card if you know they pay their bills on time. If they pay late, that will go on your credit report as well. You can get that removed, but it’s a hassle that can be avoided if you pick someone trustworthy.

To learn more about establishing credit, review our guide to How to Establish Credit.

Doing No Harm!

Be extra diligent and avoid the following at all costs.

They will reduce your credit score far more than any suggestions we make about improving it.

- Don’t miss payments or pay late (Payment History) – This is the most important mistake to avoid, as it accounts for over a third of your score. If you miss a payment or turn it in late, you’ll sink your score.

- Opening new lines of credit (New Credit): If you are trying to increase your score, don’t apply for anything that could potentially result in an offer of credit, such as a credit card. Also, credit inquiries will also lower your credit score by a few points for a while. So, it is better not to apply for new credit right now.

- Closing any open lines of credit (Amounts Owed, Length of Credit History) – When you close a line of credit, say a credit card, it impacts two factors. By lowering your total available credit, you will increase your credit utilization (bad). You also shorten the length of your reported credit history, which can be bad if you close one of your older credit cards.

- Don’t pay off that charge-off (Payment History) – If a lender “charged off” a loan, which means they’ve given up on it, it will hurt your credit score for seven years. If it’s already happened, the damage is done and is slowly subsiding. If you pay it off, it’ll reset the clock unless you’ve negotiated (get it in writing!) with the lender to have them remove it.

How to Boost Your Score

Enough doom and gloom, what can you do to increase your score?

- Pay down debts – The lower your credit utilization, the better. A person who uses just 5% of their total credit is a safer bet than someone who is using 50%. Pretty obvious the fastest way to do that is to pay down some existing debt.

- Increase your credit limits – In addition to paying down debt, increasing your credit limits will help with your credit utilization. For example, if you have a $5,000 credit limit and a $2,000 balance, your credit utilization is 40%. However, if you increase your credit limit to $6,000, your credit utilization is now 33%. Here’s how to ask a credit card how to increase your limit.

- Dispute errors – Your best shot at improving your score is to find errors and fix them. Check your credit reports and go through them very carefully for any negative marks. Do you see any accounts that aren’t yours? Dispute them. Every credit bureau has a process for disputing errors, and these can take a long time but offer the best bang for your buck (that’s why you should be monitoring your reports all the time, not just when you need good credit). For more on this, Credit Karma has a guide on disputing errors.

- Fix omissions – Credit bureaus aren’t perfect (shocker!) so check that they have all the accounts you are responsible for. You may find they’re missing ones that could improve your Payment History, Length of Credit History, Amounts Owed, or even Types of Credit In Use.

- Ask for Forgiveness – If you have a late payment, ask the lender for a “goodwill adjustment.” This works best if you have a great relationship with the lender because you’re asking them to remove the mark from your credit report. Click here for a template but make sure you edit it to build a stronger personalized case.

- Negotiate Removal – If you don’t have a great relationship (like if you’re behind on payments), you can try to negotiate a deal with a lender that involves removing those marks in return for an installment payment plan or lump sum payment.

- Try to remove charged-off accounts – If you have this on your report, try to get it removed. Here’s advice on how to do that.

- Dispute late payments, collections, etc. – Some experts don’t advocate that you dispute legitimate late payments or other negative marks. I’m telling you that this is a strategy plenty of people use with great success. Let your own moral compass guide you. This strategy works because sometimes the creditor can’t verify the details, and the mark will be removed.

✨ Related: What Will Happen to Your Credit Score if You Do Not Manage Your Debt Wisely

Let’s Keep It High

From here, it’s straightforward – keep making those payments and keep an eye on your credit reports.

How do you make sure you never miss a payment?

Two steps:

- Use no more than two cards. You don’t need five credit cards; you need at most two cards. The more cards you have, the more statements you get and the more payments you have to make. It’s sucking up your time and can lead to mistakes; get it down to just two cards.

- Set up automatic payments. I make sure I get an email notification a few days before every automatic payment, so I can review the statement for errors and confirm my bank account has sufficient funds.

How do I keep an eye on your credit reports?

The law states that you can get access to your credit reports every single year. I review each credit report on a rotating schedule, one every four months. Equifax in the Spring, Experian in the Summer, and Transunion in the Fall – all via AnnualCreditReport.com – the only place to go for your credit report.

Monitor “score” with free services

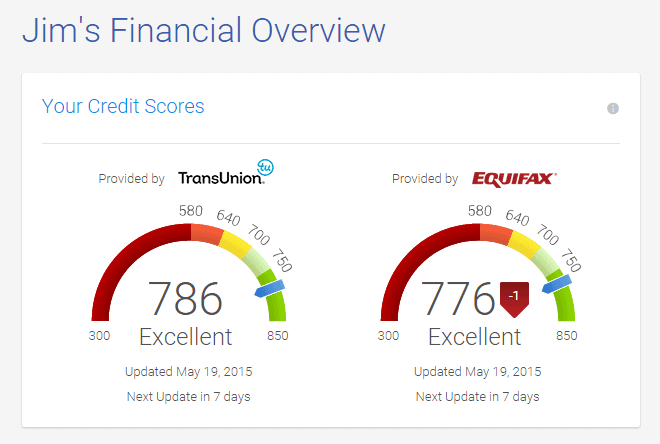

On a more regular basis I log into services at Credit Sesame, Credit Karma, and Quizzle that monitor my scores for free. They don’t provide FICO credit scores but they do offer the proprietary scores from the credit bureaus, which is good enough to act as a “canary in the coal mine” type of alert to changes.

For example, when I log into Credit Karma I see a VantageScore 3.0 from TransUnion and from Equifax.

If I see any big numerical moves, I know I need to review that credit report. A small dip, like 1 point on Equifax, isn’t worth investigating.

The following tools are available for those with poor or no credit. The key to getting a loan when you have poor credit is to reduce the risk to the lender as much as possible.

For example, secured credit cards require you to put down a deposit, then your credit limit is the amount of your deposit. This protects the lender because if you don’t pay back the loan, they can use your security deposit to recoup the funds. Since there is no risk of the lender losing money, they are willing to take a chance on you and give you the opportunity to build a positive credit history.

Experian Boost

Experian Boost is not a loan, it is a free service offered by Experian that can increase your score by reporting on time payments you make to your bills. So if you pay things like rent, utilities, and insurance, your on-time payments can be reported to Experian.

This allows for a positive credit history without taking out a loan. You just pay your bills like normal.

Here’s our full Experian Boost review to learn more.

Secured Credit Cards

Secured credit cards work just like regular credit cards, except you have to put down a deposit. How much you put down will determine your credit limit. So if you submit a $500 deposit, you will have a $500 credit limit.

Once you receive the card, however, it works just like any other credit card. You make purchases, and each month, you will be required to make at least the minimum payment by the due date. Your payment history will be reported to the credit bureaus.

Some secured cards automatically upgrade to an unsecured card after a period of time, usually around six months — assuming responsible use.

Credit Building Cards

Some of the newer fintech companies are offering what they’re calling “credit building cards.” These are credit cards that work similarly to secured cards, but you don’t have to put down a deposit. Instead, the cards are tied to your checking account, and when you spend money on the card, the money is instantly withdrawn from your checking account and set aside. The money that is set aside is then used to pay the card in full on the due date.

The on-time payment is then reported to the credit bureaus, and you build a positive credit history.

One example of this is the Chime Credit Builder Card.

Credit Builder Loans

Credit builder loans are a bit of a misnomer because they don’t really work like loans. Instead, it’s more of a forced savings plan that also builds credit.

With traditional loans, when you take out a loan, you instantly receive the proceeds and then repay the debt over time. A credit builder loan works in reverse. You make payments into a savings account with the lender, and when your loan is complete, you will receive the balance of the account.

Let’s look at a simplified example. Say you take a $1,000 credit builder loan with $100 payments for 10 months. Each month, you will pay $100, and after 10 months, you will have $1,000 in a savings account that will be released to you.

Note that in a real loan, there are fees involved, so you would not get the full $1,000. However, you would have 10 months of on-time payments reported to credit bureaus and a good amount of savings built up, so the cost may be worth it.

An example of this type of loan is the Self Credit Builder Loan.

What About Credit Repair?

If your score is low because of previously made mistakes with credit, credit repair can be a viable option to try to improve it. Whenever there are bad marks on your report, those marks stay on for a period of time and keep your score low. These are events like a late payment or bankruptcy.

What credit repair companies do is take some action to try to remove those black marks. They will do things like dispute negative items or take other steps to get them removed. They’re going to be expensive but if you have a need, they can be worth it if they are successful. They are only increasing your score by removing the negative items.

Alternatively, you can also use credit repair software (instead of companies) to help you with the process for a smaller cost. The benefit of credit repair software is that you are doing the work, so you know exactly what is happening. It takes more time, but it costs less, and you are in full control.

If you have no negative items (or no credit history at all), they cannot help you.