Federal student loans and private student loans… which is better?

Most schools, the federal government, and even private lenders recommend taking out federal student loans over private student loans.

With federal student loans, every student gets the same competitive rate, they come with more flexible repayment plans and they offer more options for deferment, forbearance, and forgiveness.

But there are a few cases where private student loans actually make more sense. If you’re not sure which is right for you, consider these five factors.

1. Are you eligible?

Not everyone can qualify for federal student loans or private student loans.

To qualify for federal loans, you must:

- demonstrate financial need for need-based federal student aid programs;

- be a U.S. citizen or an eligible noncitizen;

- have a valid Social Security number (with the exception of students from the Republic of the Marshall Islands, Federated States of Micronesia, or the Republic of Palau);

- be enrolled or accepted for enrollment as a regular student in an eligible degree or certificate program;

- be enrolled at least half-time to be eligible for Direct Loan Program funds;

- maintain satisfactory academic progress in college or career school;

- sign the certification statement on the Free Application for Federal Student Aid (FAFSA) form stating that you’re not in default on a federal student loan, you do not owe money on a federal student grant, and you’ll only use federal student aid for educational purposes; and

- show you’re qualified to obtain a college or career school education.

Private student loans also have requirements that some students might not be able to meet without a cosigner. Most have minimum income and credit requirements — two things most undergraduates generally can’t meet on their own.

But it’s possible to find a lender that’s willing to work with students who are under 18, attending a school that isn’t eligible for federal aid, or don’t have the right residency status to qualify for federal aid — as long as you have a cosigner, that is. Without a cosigner, your options are considerably limited.

Some of the best private student loans are shown in the table below:

2. Which actually has a better rate?

Federal student loan rates have been going up over the past few years.

According to Federal Student Aid, the maximum interest rates are 8.25% for Direct Subsidized Loans and Direct Unsubsidized Loans made to undergraduate students, 9.50% for Direct Unsubsidized Loans made to graduate and professional students, and 10.50% for Direct PLUS Loans made to parents of dependent undergraduate students or to graduate or professional students.

If you’re only eligible for a Graduate or Parent PLUS Loan, a private loan might actually cost less. Especially if you have a cosigner with strong personal finances — like a credit score over 750 and a low debt-to-income ratio.

However, PLUS Loans aren’t eligible for as many perks as other types of federal loans, so you might not actually be missing out on much by borrowing from a private lender.

Private student loan rates start at 3% with no origination fee. Even if you don’t get the lowest offered rate, it could be lower or close to the cost of a federal loan with a more competitive rate.

3. How much do you need to borrow?

One of the main drawbacks to federal student loans is that there are limits to how much you can borrow for its most competitive programs.

Direct Subsidized Loans and Direct Unsubsidized Loans are federal student loans offered by the U.S. Department of Education (ED) to help eligible students cover the cost of higher education at a four-year college or university, community college, or trade, career, or technical school.

These loans might be referred to as Stafford Loans or Direct Stafford Loans interchangeably, but please note that these are not the official names for these specific loans.

The amount you can borrow for school is set by your school, and it cannot be more than what you need financially.

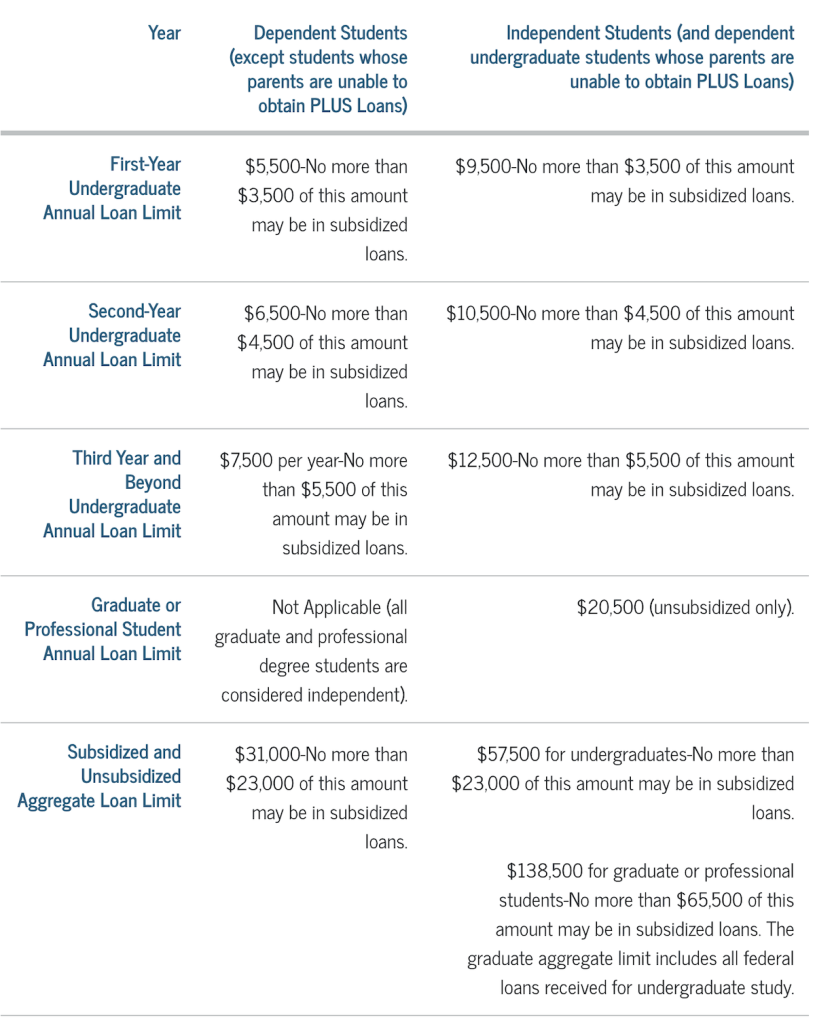

The most you can borrow through the Federal Direct Loan Program as a freshman is between $5,500 and $9,500. And you’re limited to borrowing $57,500 as an undergraduate and $138,500 as a graduate or professional student.

While $138,500 might sound like a lot, it isn’t if you’re getting a medical degree or going to law school. In these cases, you might not have any other option but to borrow from a private lender — or use a combination of both.

Private lenders typically have much higher limits or allow you to borrow up to 100% of your school-certified cost of attendance.

A note about the cost of attendance

The cost of going to college doesn’t stop at tuition and fees. Schools consider what it calls the cost of attendance (COA) when coming up with your financial aid package.

Each school has different criteria for what it considers to be your COA. It usually includes housing, meal plans, textbooks and supplies, transportation, and other miscellaneous living expenses.

Student loan providers are legally not allowed to let you borrow more than your school’s COA. That’s why private lenders reach out to your school to confirm your loan amount when you apply.

4. Can you afford to start paying off your loans while in school?

Federal student loans generally don’t require you to start making repayments until six months after you’ve graduated or otherwise dropped below half time — this includes taking a semester off.

Private student loans don’t always offer that luxury. Or when they do, they offer multiple in-school repayment options. These often include interest-only repayments, fixed repayments of around $25 or starting with full repayments right away.

While you might not be able to afford full repayments right away, making small repayments on your loan while you’re in school could actually help you save. You can do this by getting an internship while in college or using college budgeting apps to save money each month.

With the exception of Federal Direct Subsidized Loans, interest starts adding up on your federal loans as soon as your school receives the funds. When you finally start making repayments, all of that accumulated interest gets added to your loan balance — and you effectively end up paying interest on interest.

By taking out a private student loan and making small repayments early on, you could both save on your total loan cost and get out of student loan debt faster.

5. What are your plans after graduation?

What you plan on doing after graduation is an extremely important, albeit unpredictable factor to consider when choosing between federal student loans and private student loans.

Undergraduates planning on going to graduate school in the future might want to consider federal loans, which you can defer while you’re in school again. Not all private lenders allow in-school deferment.

Thinking about going into public service or working for a nonprofit? You could be eligible for full forgiveness after making 10 years of repayments on your federal loans through the Public Service Loan Forgiveness (PSLF) Program.

In fact, anyone considering traveling around or who thinks they might have a low-income job might want to choose federal loans over private, since they’re eligible for income-driven repayments. Private lenders typically only offer one standard repayment plan, and fewer deferment and forbearance options.

Federal vs Private Student Loans Summary

In the end, federal student loans are usually a more favorable choice. Private student loan providers even tend to recommend that you apply for federal aid first before you apply for their products.

But if you can’t qualify for federal aid, can get a better deal with a private lender or want to get out of debt as soon as possible, private loans could be the way to go.